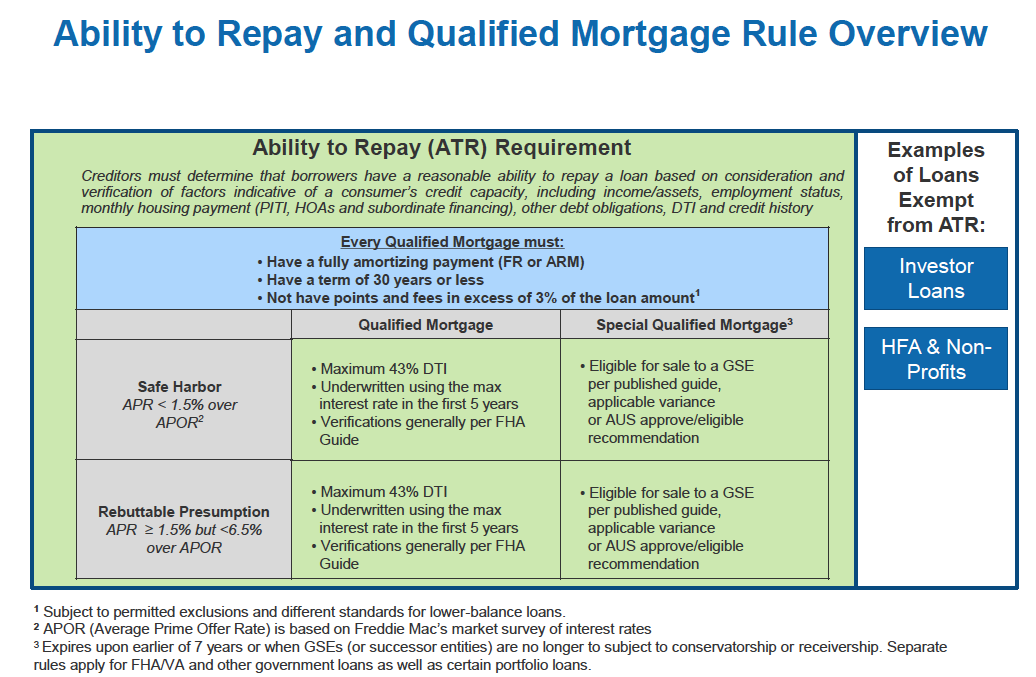

Under the rule, for first-lien transactions, a loan receives a conclusive presumption that the consumer had the ability to repay (and hence receives the “safe harbor” presumption of QM compliance) if the APR does not exceed the APOR for a comparable transaction by 1.5 percentage points or more as of the date the interest rate is set. Appendix Q and 43% DTI Requirement Removalįurther, in this final rule, the CFPB eliminates the Appendix Q 43 percent DTI underwriting requirements and replaces them with a priced-based QM definition. In other words, loans eligible to be insured or guaranteed by these agencies may still constitute QMs if they meet the agencies’ respective definitions of a QM.

#Cfpb qm rule Patch

Significantly, the expiration of the QM Patch does not affect the QM definitions that apply to Federal Housing Administration (FHA), US Department of Veterans Affairs (VA), US Department of Agriculture (USDA) or Rural Housing Service loans. In recent remarks, however, Treasury Secretary Steven Mnuchin has indicated that termination of the conservatorships is not imminent. The timing is tricky because Mark Calabria, the Director of the Federal Housing Finance Agency, the entity that supervises the conservatorships of Fannie Mae and Freddie Mae, has indicated that he might seek to terminate the conservatorships prior to President Trump’s departure from office. Notably, under the final rule, the QM Patch permanently sunsets on the earlier of (i) Jor (ii) the date that the GSEs exit conservatorship. The Final Rulemaking: QM Patch Expiration Many have criticized the QM Patch for unduly advantaging the government subsidized GSEs at the expense of the private residential mortgage market participants, and have clamored for its elimination.

What the rule did not anticipate is that the conservatorship of the GSEs would continue years after the effective date of the CFPB regulations (January 10, 2014). The regulations scheduled this exemption to expire upon the earlier of the termination of the conservatorship of the particular GSEs, or January 10, 2021. The QM Patch has significantly enhanced the presence of the GSEs in the QM market, as the GSEs are in effect backstopping the underwriting of these loans. (Such criteria include that the points do not exceed the three percent threshold, and the loan is fully amortizing and doesn’t have a term exceeding 30 years.) Consequently, a loan satisfies the QM Patch if it can be sold to one of the GSEs and meets certain other QM criteria. However, the CFPB regulations eliminate these particular requirements if the loan is eligible for purchase by, among others, Fannie Mae and Freddie Mac. In many instances, in order for a loan to achieve QM status, it must be underwritten in accordance with exacting standards of Appendix Q, and the consumer’s debt-to-income (“DTI”) ratio may not exceed a 43% hard limit.

a “rebuttable presumption” of compliance with the ability-to-repay rules to creditors or assignees for higher-priced mortgage loans.Ī “higher-priced mortgage loan” has an annual percentage rate (“APR”) exceeding the average prime offer rate (“APOR”) by 1.5 or more percentage points for first-lien loans, or by 3.5 or more percentage points for subordinate-lien loans.a “safe harbor” for compliance with the ability-to-repay rules to creditors or assignees of loans that satisfy the definition of a QM and are not higher-priced mortgage loans and.(The obligation applies to a consumer credit transaction secured by a dwelling.) The CFPB’s ability-to-repay/QM regulations, promulgated pursuant to the Dodd-Frank Act, require a creditor to make a reasonable, good-faith determination at or before consummation that a consumer will have a reasonable ability to repay the loan according to its terms. We will discuss that rulemaking in a separate post. In a separate rulemaking, the CFPB promulgated new rules for “seasoned QM loans”. The QM Patch will expire on the earlier of (i) Jor (ii) the date that the GSEs exit conservatorship. The rule takes effect on February 27, 2021, but compliance with it is not mandatory until July 1, 2021. Notably, in this rule, issued on December 10, 2020, the CFPB replaces the dreaded Appendix Q and strict 43% debt-to-income underwriting threshold with a priced-based QM loan definition. In a significant final rulemaking with potentially far-reaching consequences for the residential mortgage markets, the Consumer Financial Protection Bureau (“CFPB”) is terminating the “QM Patch” and significantly revising the criteria for what constitutes a qualified mortgage (“QM”) loan.

0 kommentar(er)

0 kommentar(er)